Mega888 – The Future of Online Gambling

Mega888 – The Future of Online Gambling

Mega888 is an excellent online casino that provides players with the ultimate entertainment experience. It boasts a vast selection of games and can be accessed on both Android and iOS devices.

Casino Paradise offers both modern and classic casino games for players to explore. Additionally, it has some arcade titles that many enthusiasts enjoy playing.

It offers a variety of games

Are you in search of some exciting slots or table games? Mega888 has it all. With an extensive selection and new releases every month, there’s sure to be something here that appeals to your tastes.

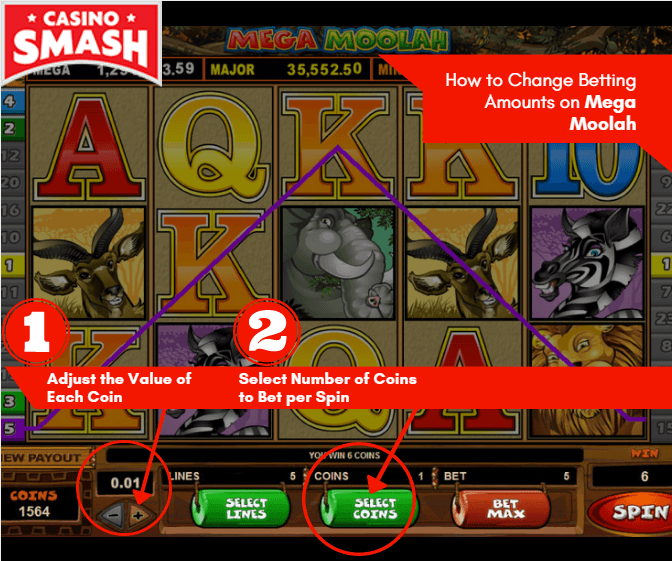

Mega888 makes learning the casino game of chance a breeze with its user-friendly interface and practice accounts that let you practice before betting with real money. If you’re new to the scene, Mega888 provides an accessible learning platform.

Mega888 not only offers slots, but a vast selection of classic arcade games such as Battle World and Racing Car. These titles provide an immersive experience with stunning visuals and top-notch content.

It offers fast payouts

Mega888 is a top online casino that has gained widespread acceptance in countries like Singapore, Malaysia, Thailand and Indonesia. It provides fast payouts and an extensive selection of games for players to enjoy.

Another reason this casino is popular is its ease of use. It boasts a user-friendly interface, is mobile optimized and offers excellent customer support.

It offers a secure environment for players to play. It holds the license from eGaming Curacao and all its games undergo auditing by BMM Testlabs to guarantee fairness.

Mega888 offers a vast selection of online slot games, but it is essential that you select the one best suited for you. Doing so could net you more money and boost your chances at hitting the jackpot!

It offers 24 hour customer support

Mega888 provides around-the-clock customer support for players worldwide, which is especially helpful since many gamblers cannot access their online casino during public holidays or other events.

When you need assistance with your account or questions about the game’s terms and conditions, Mega888 customer service team is available to assist. They answer any queries via email, phone call, and live chat.

Customer support is an integral element of any online casino, and Mega888 prioritizes providing excellent customer service to maintain a positive image. As such, their staff guarantee responses to queries within three minutes.

It offers a safe environment

Mega888 is an innovative casino that provides customers with the newest in online gambling technology, such as its user-friendly mobile app that works across various devices. Furthermore, their customer support team and selection of games are second to none.

It’s no shock that this casino has established itself as a reliable player in the industry and Malaysia’s premier destination for online slots play. Licenced by Singapore government authorities and recognized by online watchdogs and licensing companies alike, you can rest assured knowing this establishment meets all safety requirements.

The site offers an impressive selection of games, such as blackjack and roulette. Furthermore, they are the first to offer an interactive mobile app so players can play their favourite slots while on-the-go. Furthermore, encryption technology keeps your data safe from prying eyes while you enjoy yourself at the site.

/GettyImages-200443052-001-596853f03df78c57f49b3034.jpg)